In a move that Republican leaders say cut off negotiations, the House passed a bill on Sunday that nets $5.4 billion in revenue by raising income and corporate taxes.

Reps. Carol Sente (D-Vernon Hills), Elaine Nektritz (D-Northbrook) and Scott Drury (D-Highwood) voted for the 33 percent tax hike.

Reps. Barbara Wheeler (R-Crystal Lake), David McSweeney (R-Barrington Hills), Nick Sauer (R-Lake Barrington), Sheri Jesiel (R-Winthrop Harbor), Rita Mayfield (D-Waukegan) and Sam Yingling (D-Grayslake) voted against it.

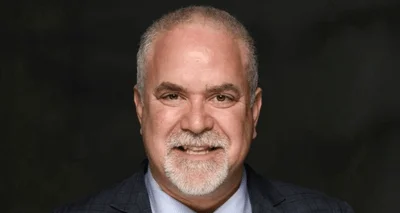

David McSweeney (R-Barrington Hills)

Senate Bill 9 would raise the personal income tax rate to 4.95 percent from 3.75 percent and the corporate tax rate to 7 percent from 5.25 percent.

Many Republicans, including House Minority Leader Jim Durkin (R-Western Springs), criticized the bill, saying it does not address the underlying problems in the state. Durkin was disappointed to see negotiations stopped.

“We [Republicans] have participated in good faith,” Durkin said. “I have, every day, worked to find the right balance in how we can fix Illinois, not just by raising taxes but by reducing spending and also making sure there are meaningful reforms to make Illinois an attractive state for families and businesses. Without that, the exodus will continue. I am disappointed that we are taking this up at this moment when there has been significant progress [made] to address the priorities of the governor and also the priorities of the caucus.”

SB9 passed 72-45 and awaits a Senate vote.

ORGANIZATIONS IN THIS STORY

!RECEIVE ALERTS

DONATE

Alerts Sign-up

Alerts Sign-up