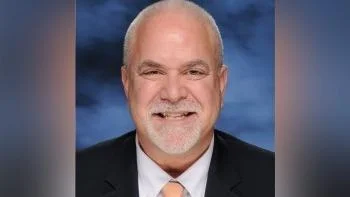

State Rep. David McSweeney | Contributed photo

State Rep. David McSweeney | Contributed photo

State Rep. David McSweeney (R-Barrington Hills) spent the final hours before Election Day preaching the same sermon he has all year when it comes to Gov. J.B. Pritzker’s progressive tax plan.

“Make no mistake about, the progressive income tax hike is a code phrase for an eventual massive tax increase on the middle class,” McSweeney said. “Many Illinois residents are struggling, but the governor still wants to raise taxes with his progressive income tax hike. This is outrageous.”

Despite the governor continuing to sell the tax he has been promoting since his days as a candidate as a plan that will only mean higher rates for the state’s most affluent residents, Pritzker isn’t buying it.

“While the governor fights to raise taxes again, I’m fighting to strengthen our economy and bring jobs back to Illinois,” he added.

McSweeney has hardly been alone in expressing his disdain for a plan he argues has little chance of being what it’s advertised as. Government watchdog website Wirepoints recently dissected the plan and arrived at the conclusion it is riddled with inconstancies that are primed to cost already frustrated taxpayers out of even more of their hard-earned money.

Among the issues raised by Wirepoints is its contention that the state’s “true hole” is in the neighborhood of $19 billion, or well over 6 times greater than the $3.2 billion debt estimate admitted to by Pritzker as part of his administration’s analysis. McSweeney argues it all sets the stage for more of the tax and spend policies that have long left the state in a lurch.

“The progressive income tax, the linchpin of the Pritzker plan, wouldn’t hurt the wealthy a lot – they easily can move out of Illinois,” McSweeney recently wrote in an op-ed for Illinois News Network. “It would harm the middle class. There is a reason we do not see a tax rate schedule from those supporting the progressive income tax. They do not want voters to see exactly who the progressive income tax will affect. Do you really trust Illinois career politicians to set your tax rates?”

Alerts Sign-up

Alerts Sign-up