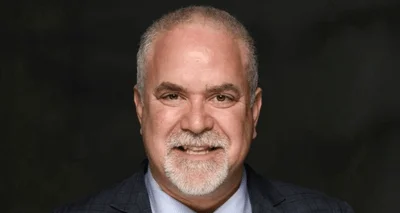

Rep. David McSweeney

Rep. David McSweeney

Republican state Rep. David McSweeney (R-Barrington Hills) is not about to take the abuse he sees coming from Gov. J.B. Pritzker’s progressive tax plan in silence.

“I’m leading the fight against the progressive income tax because Illinois taxes are too high,” McSweeney told the Lake County Gazette. “The progressive tax is a code phrase for a massive hike.”

McSweeney is not alone in protesting that Pritzker’s long-touted plan will do few of the things it is being advertised to.

Gov. J.B. Pritzker

Government watchdog website Wirepoints recently dissected the plan the governor insists will only mean higher tax rates for the state’s most affluent residents, coming to the conclusion the plan is filled with deceit and only aimed at fleecing already frustrated taxpayers out of even more of their hard-earned money.

While Pritzker has long touted the plan as one that will finally help the state put its financial struggles behind it by reducing property taxes, addressing pension debt and generating additional funding for a number of state programs, Wirepoints sees things in a totally different light.

For starters, analyst at the website peg the state’s “true hole” in the neighborhood of $19 billion, or well over six times greater than the $3.2 billion debt estimate admitted to by Pritzker as part of his administration’s analysis.

If the tax ever sees the light of day, McSweeney argues there will be no shortage of victims.

“The progressive income tax, the linchpin of the Pritzker plan, wouldn’t hurt the wealthy a lot – they easily can move out of Illinois,” McSweeney recently wrote in an op-ed for Illinois News Network. “It would harm the middle class. There is a reason we do not see a tax rate schedule from those supporting the progressive income tax. They do not want voters to see exactly who the progressive income tax will affect. Do you really trust Illinois career politicians to set your tax rates?”

Alerts Sign-up

Alerts Sign-up