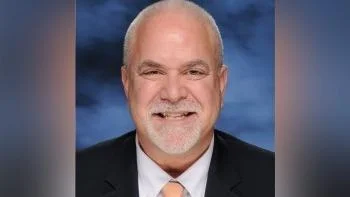

State Rep. David McSweeney (R-Barrington Hills) | http://www.davidmcsweeney.com/

State Rep. David McSweeney (R-Barrington Hills) | http://www.davidmcsweeney.com/

State Rep. David McSweeney (R-Barrington Hills) wants to see Springfield doing more as the deadly coronavirus shows few signs of slowing down.

“Illinois families are hurting,” McSweeney told the Lake County Gazette. “The Illinois General Assembly should be in emergency session now to cut the sales tax rate and property tax levies and to appropriate emergency funding where needed. Enough politics and memes by our leaders, the time for action is now.”

When it comes to economics, since mid-March, first-time claims for unemployment across the country have jumped by more than 3,000% as businesses large and small continue to layoff and furlough workers.

During the first week of this month, roughly 7 million U.S. workers filed for their first week of unemployment benefits, a new high for the country according to the Department of Labor.

Overall, the nearly 10 million workers filling for first-time unemployment benefits over the last two weeks represents about 6% of the total workforce.

Again, McSweeney wants to see action.

“It’s time for our leaders in Springfield to cut the Illinois sales tax rate by 25% and cut property tax levies to help families and small businesses,” he said.

Rules governing who can file for unemployment benefits vary from state to state, but given the crisis situation the federal government has waived many restrictions. Independent contractors and self-employed people are also now eligible to apply for temporary benefits through a pandemic unemployment assistance program created.

Gov. J.B. Pritzker enacted a stay-at-home order on March 20 that shuttered all businesses other than those deemed essential by the government. Even many of the operations that remain open for business are working in a limited capacity, such as restaurants, which are only doing takeout and delivery, and many stores that are only open during limited hours.

Alerts Sign-up

Alerts Sign-up