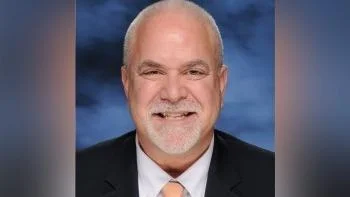

Illinois state Rep. David McSweeney (R-Barrington Hills)

Illinois state Rep. David McSweeney (R-Barrington Hills)

Illinois state Rep. David McSweeney (R-Barrington Hills) points to a new Moody’s Investors Services report that designates the state’s rising pension debt to be the highest in the country as more proof that lawmakers need to rethink their approach to Illinois' fiscal crisis.

“Despite the massive 32-percent income tax increase, Illinois public employee pension debt is the worst in the nation,” McSweeney posted on Facebook. “Raising taxes is not the solution. We must pass real reforms and cut taxes.”

According to Moody’s, as of fiscal year 2018, the state’s unfunded public pension liability stood at $241 billion, or nearly $19,000 per resident. Overall, that equates to upwards of 500 percent of state revenues or nearly 30 percent of the entire Illinois economy and counting, with researchers forecasting pension liabilities across the country could rise by as much as another 20 percent in fiscal year 2020.

McSweeney, who has served in Springfield since 2013, has long insisted the state desperately needs to tackle its ongoing pension crisis in order to alleviate the negative consequences of its trickle-down effect.

“Pension liabilities are rising so fast that local governments are continuing to raise property taxes on families,” he previously posted on Facebook after it was reported that average home prices in Cook County are down by nearly one-third when adjusted for inflation, while average property taxes have spiked by 22 percent over that same period.

Researchers added that while average home prices across the country have yet to fully recover since the end of the Great Recession, again Illinois is in a dubious class of its own, with average home prices across the country down from their peak by just five percent compared to Illinois’ 500 percent drop.

“We need real Illinois public employee pension reform so that we can cut taxes for Illinois families,” McSweeney said.

Alerts Sign-up

Alerts Sign-up