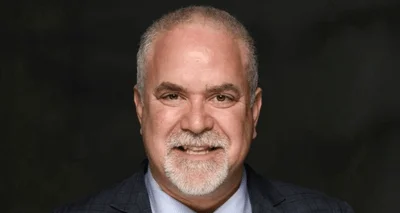

Darby A Hills, Illinois State Senator from 26th District (R) | www.facebook.com

Darby A Hills, Illinois State Senator from 26th District (R) | www.facebook.com

The bill, introduced as SB2693 on Oct. 14, 2025, during the general assembly session 104, was summarized by the state legislature as follows: "Amends the Personnel Code. Provides that a veteran is qualified for a preference of 5 points if the veteran served in active service for a total consecutive or non-consecutive period of at least 3 years, including as a member of the Illinois National Guard in service to the State of Illinois and including for training or other purposes. Adds a definition."

The following is our breakdown, based on the actual bill text, and may include interpretation to clarify its provisions.

In essence, this bill amends the Illinois Personnel Code to modify veteran preference criteria for state employment. A veteran can receive a preference of 10 points if they hold proof of a service-connected disability or have received a Purple Heart. A 5-point preference is available for veterans who have served in active duty for at least three years or 1,095 days, or under several specific conditions related to hostilities and discharge due to disabilities. Additional 3-point preferences apply to veterans with six months of service, those discharged on hardship, or with certain service-connected disabilities in the Illinois National Guard or reserve components. The bill also extends preferences to surviving spouses, and parents of deceased or disabled veterans, with the Department of Central Management Services responsible for verifying eligibility, requiring documents such as a certified DD214.

Hills has proposed one other bill since the beginning of the 104th session.

Bills in Illinois follow a multi-step legislative process, beginning with introduction in either the House or Senate, followed by committee review, floor debates, and votes in both chambers before reaching the governor for approval or veto. The General Assembly operates on a biennial schedule, and while typically thousands of bills are introduced each session, only a fraction successfully pass through the process to become law.

You can read more about bills and other measures here.

Hills, a Republican, was elected to the Illinois State Senate in 2025 to represent the state's 26th Senate District, replacing previous state senator Dan McConchie.

| Sponsor(s) | Bill Number | Date Introduced | Short Description |

|---|---|---|---|

| Darby A. Hills | SB2693 | 10/14/2025 | Amends the Personnel Code. Provides that a veteran is qualified for a preference of 5 points if the veteran served in active service for a total consecutive or non-consecutive period of at least 3 years, including as a member of the Illinois National Guard in service to the State of Illinois and including for training or other purposes. Adds a definition. |

| Darby A. Hills | SB2682 | 10/14/2025 | Amends the Sexual Exploitation in Psychotherapy, Professional Health Services, and Professional Mental Health Services Act. Changes the long title of the Act. Changes the short title of the Act to the Therapist Abuse Prevention and Accountability Act. Provides that a cause of action against a therapist or unlicensed health professional for abuse exists for a client or former client for injury caused by the abuse by the therapist or unlicensed health professional, if the abuse occurred: (1) during the period the client was receiving therapy from the therapist or health services from the unlicensed health professional or (2) within 2 years after the period the client received therapy from the therapist or health services from the unlicensed health professional. Provides that the consent of the client or former client is not a defense to a cause of action under this provision. Provides that a person is deemed incapable of consent when he or she is a person who is in a therapeutic relationship or has been in a therapeutic relationship within the previous 2 years with the therapist. Provides that a therapist must report any observed or suspected therapist abuse to the Department of Financial and Professional Regulation and to a local law enforcement agency. Provides that failure to report the abuse is subject to the criminal penalties provided in the Criminal Code of 2012 and disciplinary action by the Department of Financial and Professional Regulation. Makes other changes. Defines terms. Amends the Criminal Code of 2012 to make conforming changes. |

| Dan McConchie | SB1251 | 01/24/2025 | Amends the Illinois Vehicle Code. Provides that it shall be grounds for dismissal of a standing, parking, compliance, automated speed enforcement system, or automated traffic law violation if the state registration number or vehicle make specified is incorrect. Effective immediately. |

| Dan McConchie | SB0216 | 01/22/2025 | Amends the Property Tax Extension Limitation Law in the Property Tax Code. Provides that a taxing district shall reduce its aggregate extension base for the purpose of lowering its limiting rate for future years upon referendum approval initiated by the submission of a petition by the voters of the district. Provides that the extension limitation shall be: (a) the lesser of 5% or the average percentage increase in the Consumer Price Index for the 10 years immediately preceding the levy year for which the extension limitation is being calculated; or (b) the rate of increase approved by the voters. Effective immediately. |

| Dan McConchie | SB0253 | 01/22/2025 | Amends the Use Tax Act, the Service Use Tax Act, the Service Occupation Tax Act, and the Retailers' Occupation Tax Act. Provides that, beginning on July 1, 2025, the 1% rate of tax on modifications to a motor vehicle for the purpose of rendering the motor vehicle usable by a person with a disability applies to tangible personal property that is installed in or on a motor vehicle before, during, or after the purchase of the motor vehicle for the purpose of rendering the motor vehicle usable by a person with a disability. Provides that the 1% rate of tax on that property applies only if the tangible personal property is separately itemized on the bill or invoice for the sale of the motor vehicle or if the tangible personal property is purchased separately from the motor vehicle and is separately itemized on a bill or invoice. Effective immediately. |

Alerts Sign-up

Alerts Sign-up